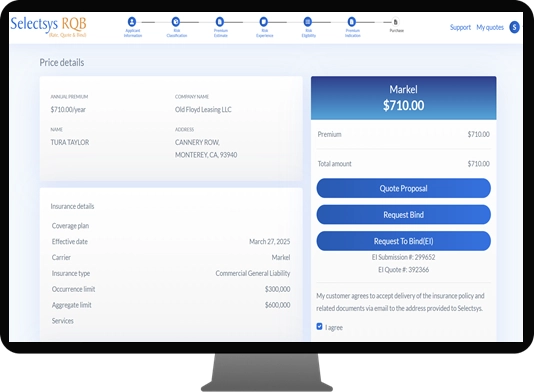

Modern Quoting for Every Line of Business

Selectsys RQB supports personal and commercial lines, including:

- General Liability

- Property

- Builders Risk

- Auto Guard

- Workers Comp

- Cyber

- Professional Liability

- Tech E&O

- Excess

- Flood

- Cargo

- Health

- Occupational Accident